Lassen County Supervisors

$25,000 Discretionary Fund

" A legal slush fund"

The Lassen County Supervisors established Special Departmental Expense Fund 100/Budget Unit 11/Account 3002800 to spend at their discretion for personal use. The only criteria to donate these funds was that they must be given to organizations that claim to be a 501 (c) 3 or 4 tax exempt corporate organization, schools, fire departments, libraries or other public entities that can provide the most support and votes for the Supervisors campaigns for re-election. However, they have departed from their requirement that the donations to non-public entities must be a registered 501(c) 3 or4 or one of the 29 categories of non-profit tax exempt businesses.

APRIL 20, 2018

discrimination fund

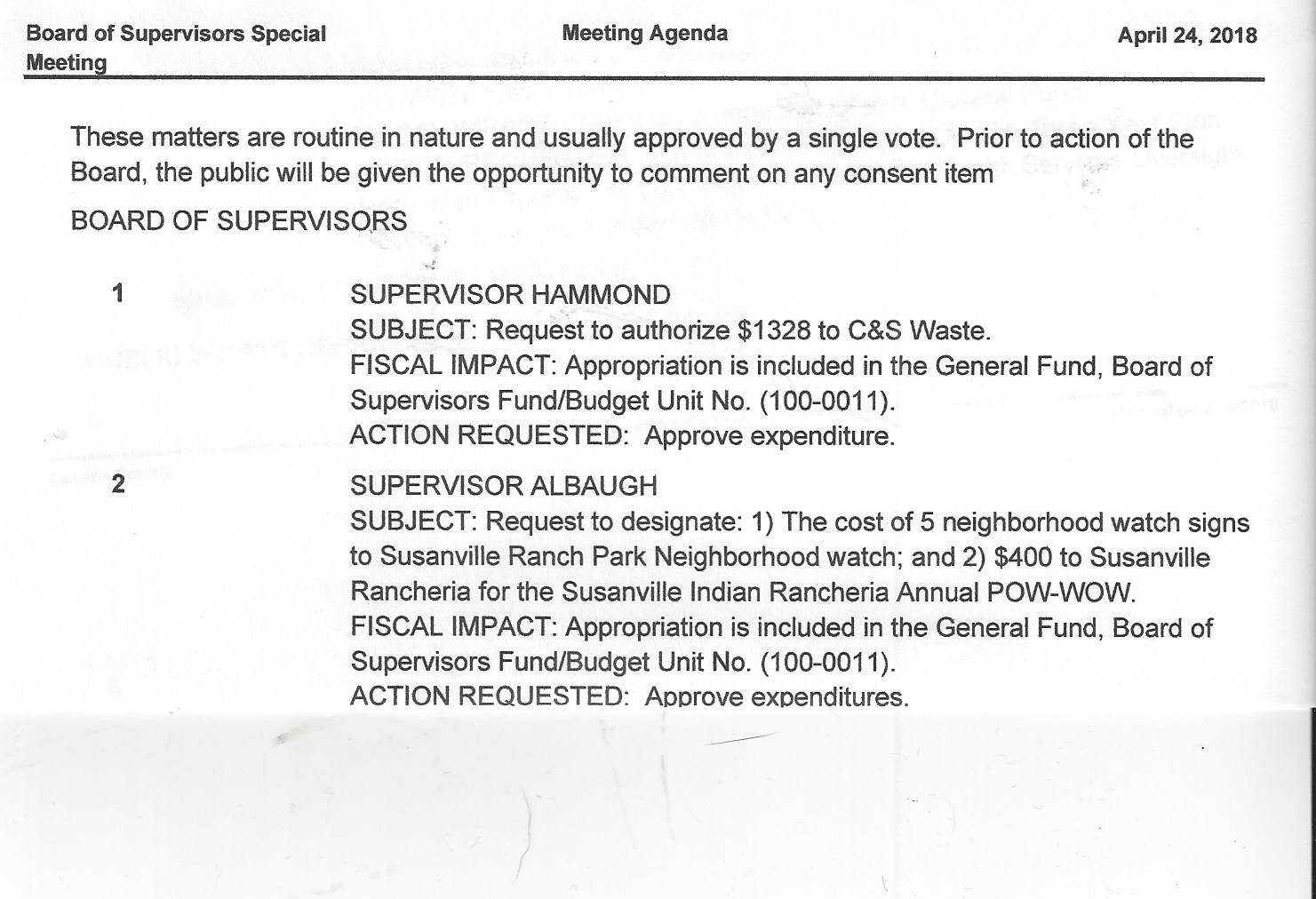

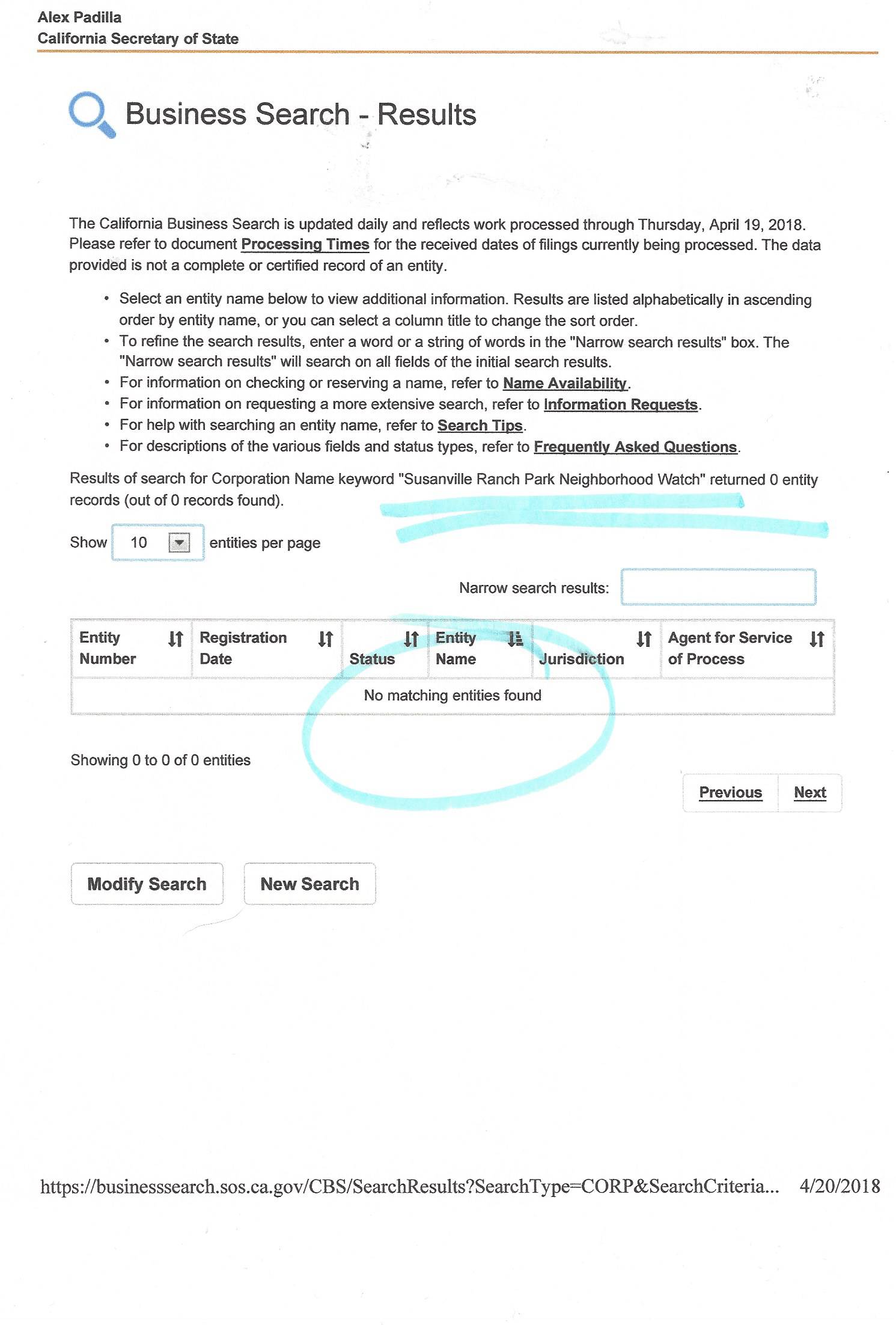

Supervisor Albaugh attempts to donate $400 to the Susanville Ranch Park Neighborhood Watch for signs.

Supervisor Tom Hammond attempts to donate $1328 to C&S Waste, not a non-profit. Hammond doesn't state the reason for this "donation" (?)

These are non-qualifying donations (Fund 100-0011) to these businesses according to Lassen County's

"Discretionary Fund" policy

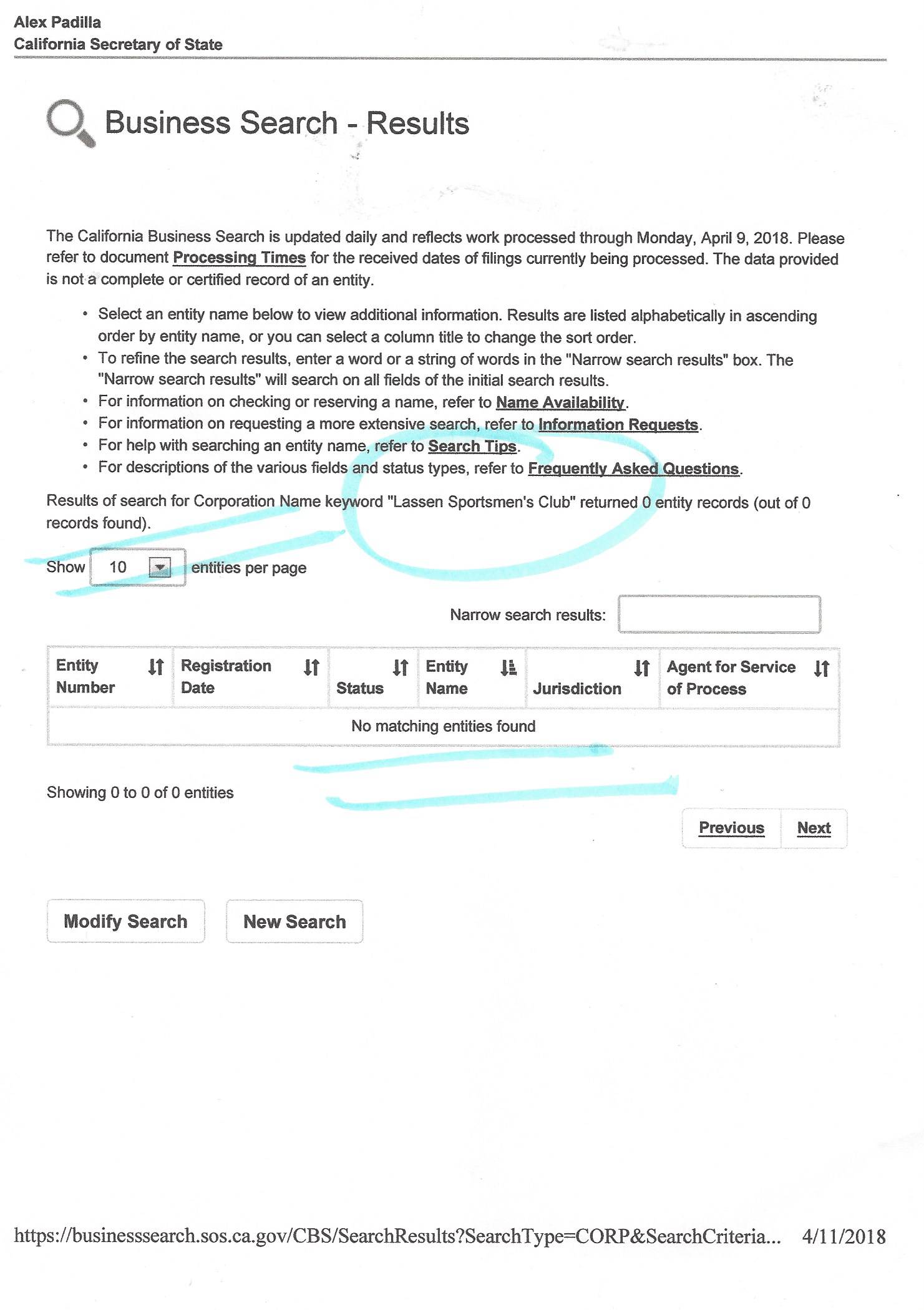

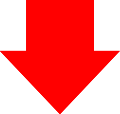

The California Secretary of State does not recognize any of these businesses as 501(c) 3 tax exempt non-profit corporations.

In January, the County refused to honor Chris Gallagher's $500 donation to the newly formed Westwood Watch because they stated that this "non-profit association" was not a tax-exempt 501(c) 3 or 4 corporation.

However, two other Watch's (Spalding & North Central) were given donations earlier, by the Supervisors, from their "Slush Fund". These two associations are not 501(c)3 or 4 tax-exempt corporations according to the IRS, Franchise Tax Board or California Secretary of State.

APRIL 17, 2018

Lassen County Discrimination Fund

For decades the Lassen County Supervisors have been allowed to have a "slush fund". The Budget amount has gone up and down over the years but the discriminatory practice of the disbursements remains the same.

Public records show that this slush fund account has been abused and has donated to non-public entities, non-tax exempt entities and many "individuals".

DISCRETIONARY FUND

Public records show that the 2013/2014 Budget donated 27% to non-qualifying businesses

Public records show that the 2014/2015 Budget donated 35% to non-qualifying businesses

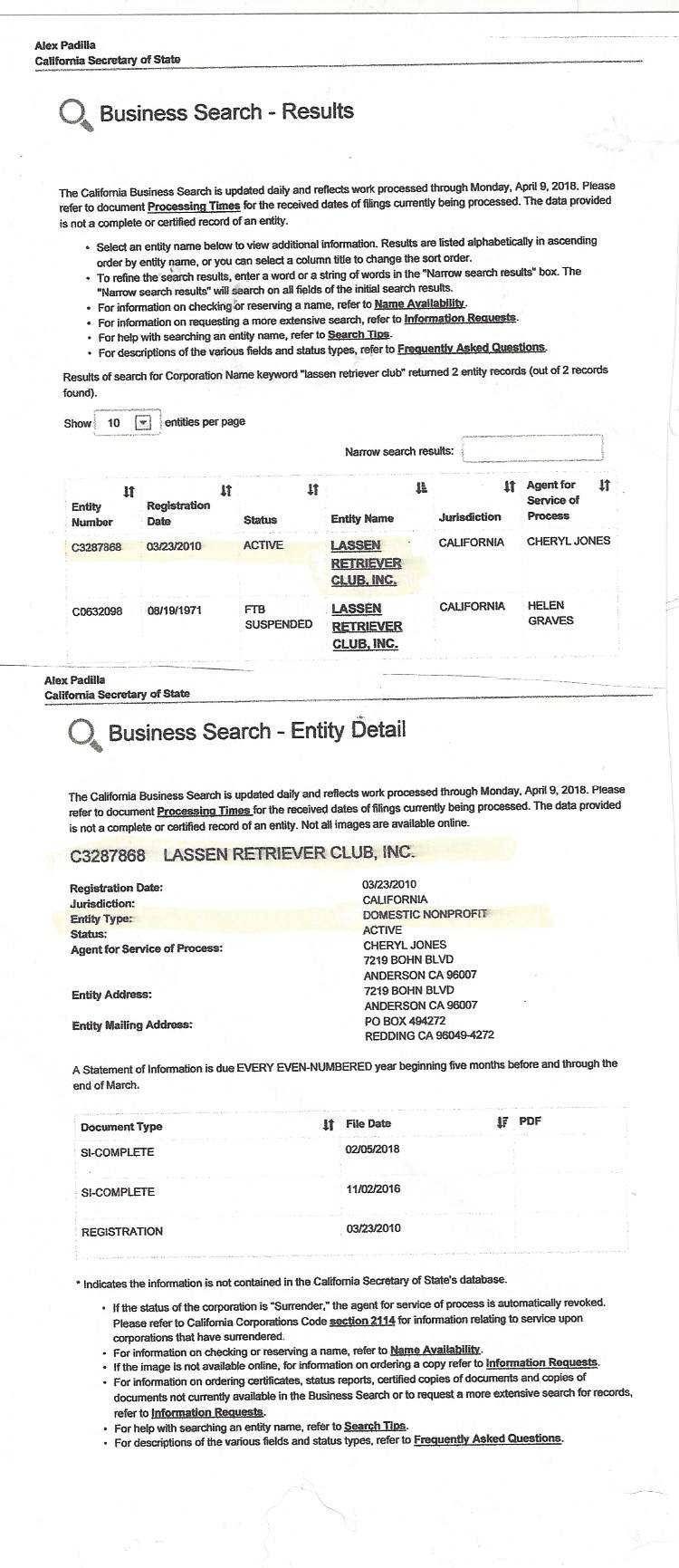

Public records show that the 2015/2016 Budget donated 37% to non-qualifying businesses

Public records show that the 2016/2017 Budget donated 32% to non-qualifying businesses

The Lassen County Supervisors and the Lassen County Times claim that these non-qualifying businesses are in fact tax-exempt businesses may be the biggest tragedy.

The 156 businesses that have been identified as non-tax exempt businesses may not be aware of the false statements made by the Lassen County Times and the Lassen County Supervisors.

Kan We Help has notified the Lassen County Auditor that proper identification has to be made in order to issue 1099 Forms to the 156 businesses that are not tax-exempt corporations that have received donations.

Kan We Help has notified the Secretary of State of Lassen County's improper practices

*501(c) 3 and 4 status gives these non-profit corporations the ability to give tax-deductible status to their donors.

(a registered "non-profit association" does not have tax-exempt status nor can they tell donors that their donations are tax-deductible)

APRIL 11, 2018

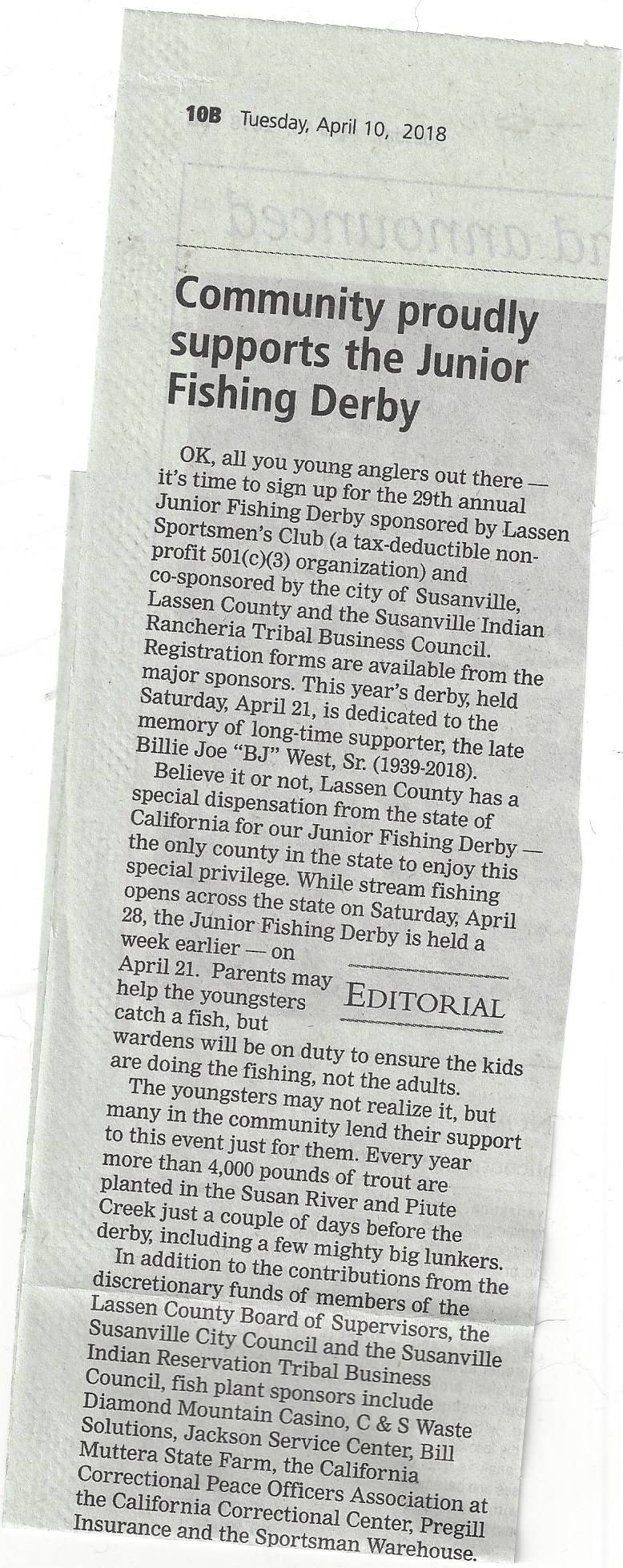

The Lassen County Times

continues to do the community a disservice

by claiming that donations to the Lassen Sportsmen's Club

are tax deductible.......they simply are not !

While this event is a worthwhile event, deceit is not an option

The IRS can impose a penalty up to $10,000 for "claiming to be" a

501 (c) 3 non-profit organization.

There is no record of this Club ever registering to be a 501(c) 3 corporation. No record with the IRS or the California Franchise Tax Board. That has been confirmed !!!!!

The Lassen Sportsmen's Club must come forward and correct the statements made by the Lassen County Supervisors [with the exception of Supervisor Albaugh who voted NO on the Lassen Sportsmen Club donations] and the Lassen County Times.

If the Lassen Sportsmen's Club does not release a public correction , a complaint will be filed by Kan We Help to the IRS, Secretary of State and the Franchise Tax Board.

The Lassen Sportsmen's Club

is not a tax exempt club.

Here is an example of a legitimately registered

501(c) 3 Club that can offer tax deductions

July 13, 2016

The Lassen County Supervisors Voted to Spend

$21,176.32 of their Discretionary Fund

for the

2015-2016 Fiscal Year

September 15, 2015

On September 15, 2015, the CAO Richard Egan claimed that the funds were not divided equally (2014/2015 Budget- $25,000 divided by 5) and the funds can be used as the Supervisors choose.

9/15/15 Video: Discussion on Discretionary Fund Spending

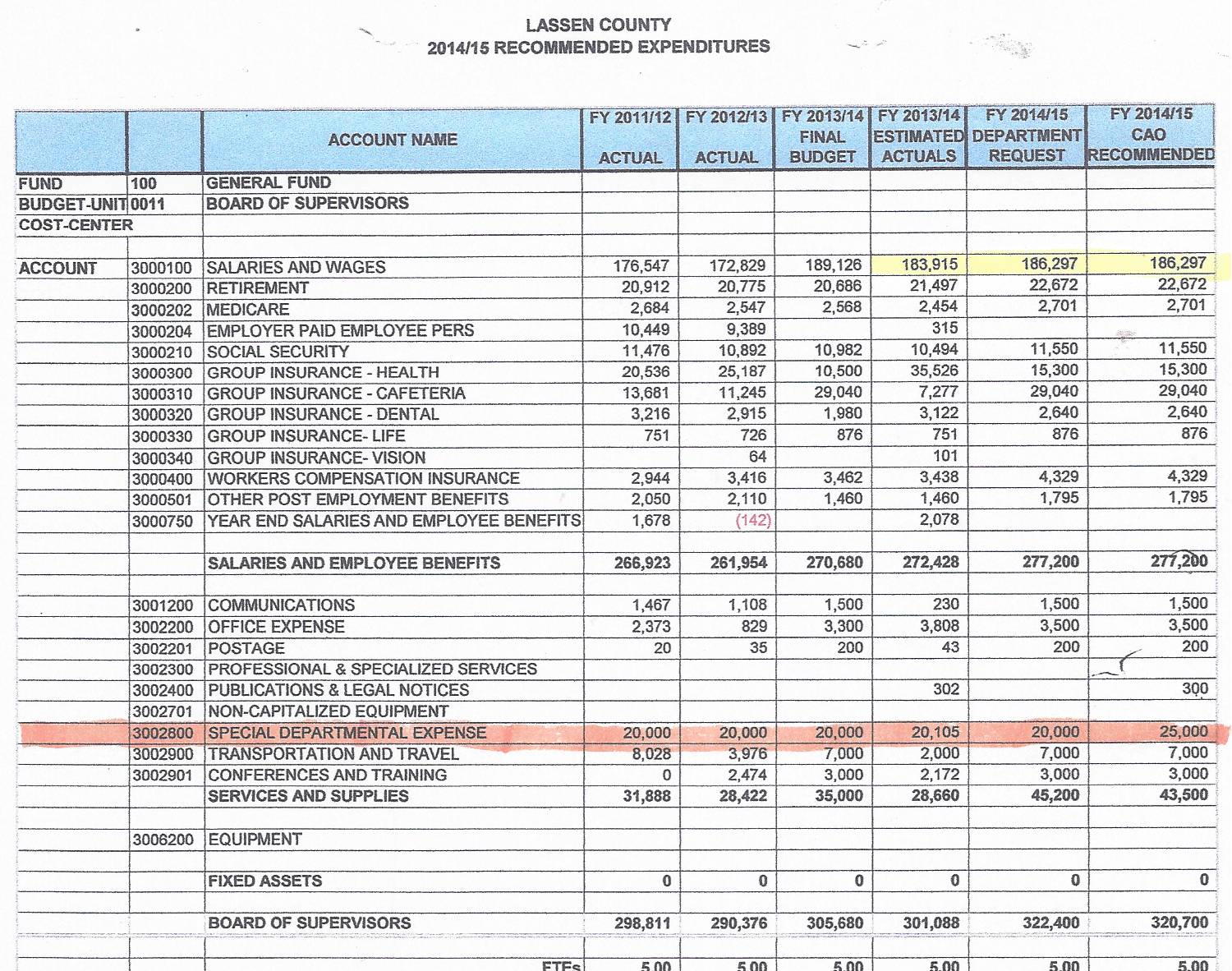

In the 2011/2012 Budget the Supervisors spent exactly $20,000

In the 2012/2013 Budget the Supervisors spent $20,000

According to the 2013/2014 Budget the

Supervisors overspent their $20,000 by

$4,854.80

The Auditor's Records show that the Supervisors approved these expenditures.

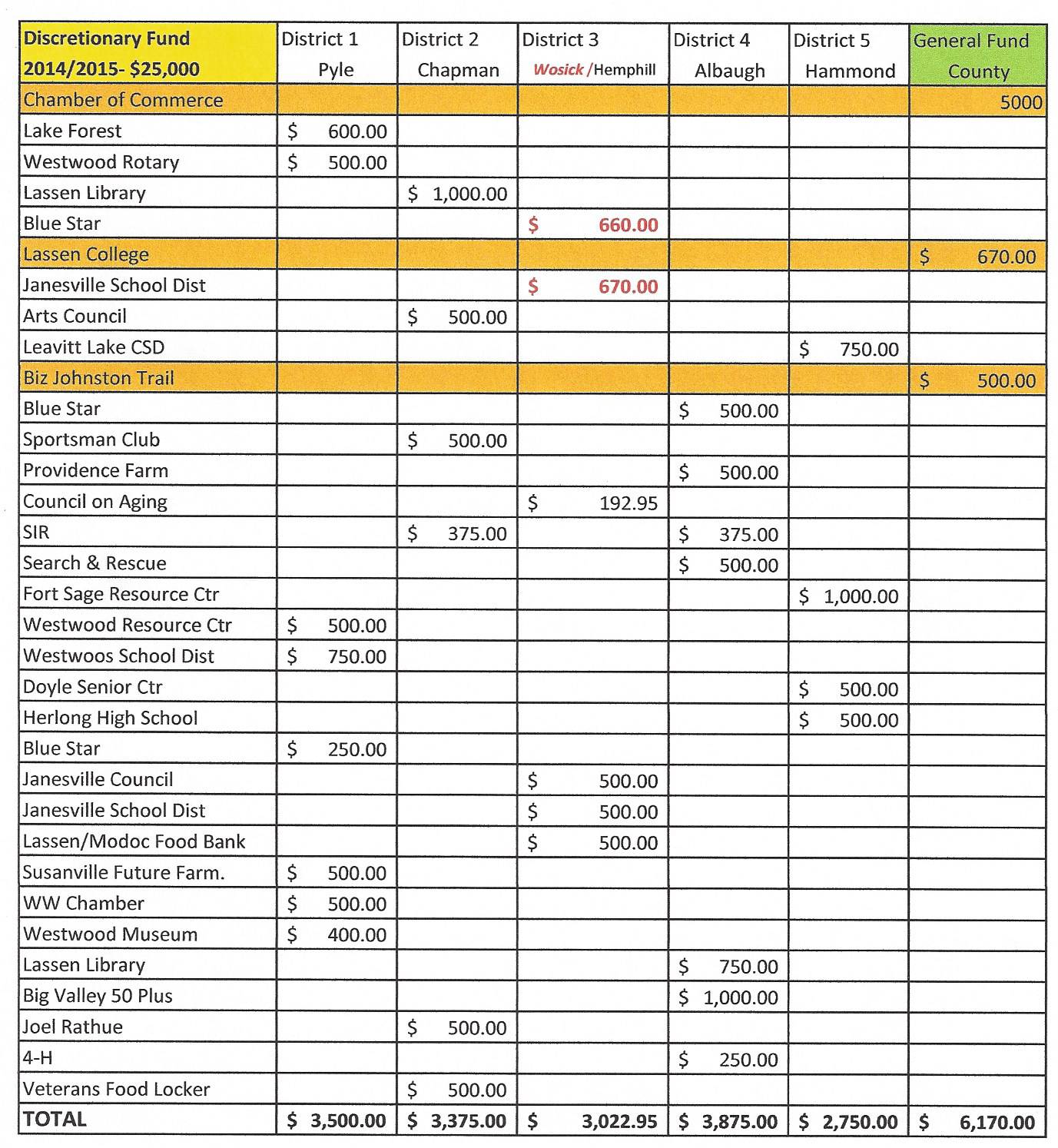

In the 2014/2015 Budget the Supervisors raised their Slush Fund to $25,000